This fintech, celebrating only its second birthday , reported 180 new contracts in June, all-time-record and threefold the figures reported in June 2019. May and June’s figures alone approximate to the annual sales of an average traditional dealership. For comparison, prior to the pandemic, a conventional dealership in Poland would either sell or lease approximately 350 cars a year (inclusive of large fleet acquisition corporate orders).

In contrast to a traditional dealership, ‘Carsmile’s’ focus is on individuals and single person companies. Furthermore, this novel fintech runs its business entirely online. Thanks to its innovative technology, within a two year period, ‘Carsmile’ has gained a 15% share of the auto subscription market for individuals and small companies.

Lukasz Domanski, OTOMOTO Lease CEO, previously working within the banking sector:

“The COVID 19 outbreak has unexpectedly changed customers’ attitudes and behaviours. People are used to shopping online for electronics, clothes and plane tickets. Now they make use of the internet and mobile apps to acquire an unprecedented range of products, from fresh food to cars. This is the new trend that won’t stop even when the pandemic is over”.

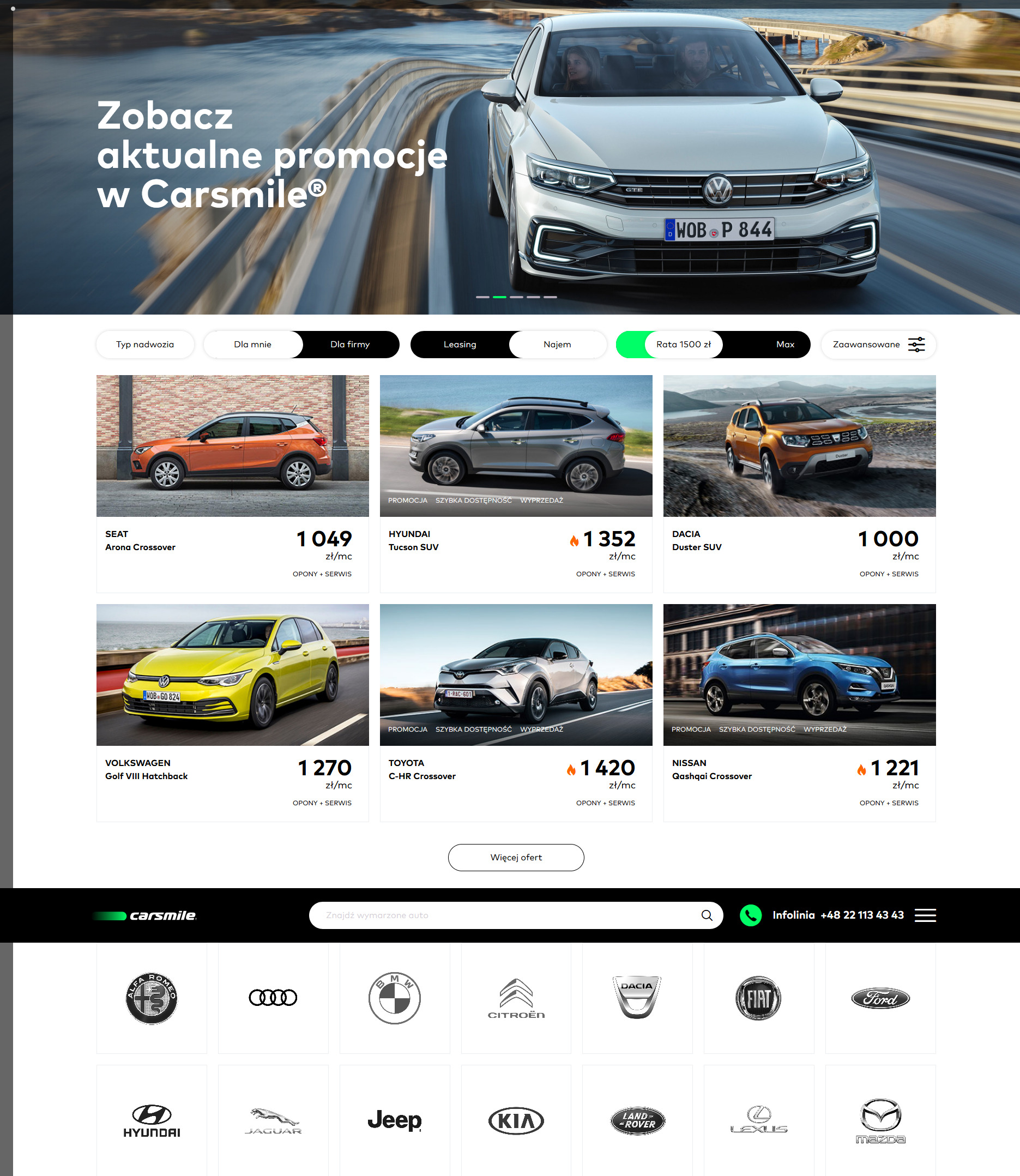

OTOMOTO Lease conducts its operations through its market disruptive software, hosted by ‘carsmile.pl’. They seek to constantly improve their customer experience. As a result, finding, setting up and finally leasing your new car has never been easier. The site uses remarketing to tap internet and mobile users’ preferences and then guides them through a step by step process to the final car subscription agreement. The majority of ‘Carsmile’s’ users search for a car on their mobiles. Thanks to the RWD and AWD solutions, the process is available through multiple platforms including phone-based apps as well as browsers.

The process consists of: drawing internet and mobile users onto the platform and offering them a wide range of almost 1000 different models of cars, representing the vast majority of auto makers. This enables users to digitally authenticate, credit score, book test drives and finally download and electronically sign subscription agreements. Contract durations range from between two to five years. An entire transaction can last no more than a few minutes. The car is then delivered to the customer’s door (under the anti-COVID contactless procedure).

OTOMOTO Lease has developed its own credit score engine that enables them to verify its users’ financial status within seconds – a process that is entirely digital. This kind of technology has never been used before in the car leasing or auto subscription market. The innovative software utilises credit score systems currently used by digital banking platforms, but is additionally enriched in an intelligent algorithm that anticipates the future value of the car, based on the assumed vehicle usage. Thanks to this, clients are able to instantly see the cost of leasing a vehicle and at any time, 24 hours a day, place an order.

Michał Knitter, OTOMOTO Lease board member and vice president, a former digital banker, says:

“It’s not a miracle that we are reporting these record sales, whilst the European automotive industry is contracting by 67% on a yearly basis with new car registrations in Poland are falling at a similar pace. It’s an absolute belief that within five years, one out of four new cars sold in Poland will be acquired online. The pandemic crisis has only accelerated this inevitable future”

OTOMOTO Lease is a private company that was set up and founded by Domanski and Knitter. Over the last 18 months the majority stake in it has been acquired by ‘Solter Capital VC’. OTOMOTO Lease is now also close to leasing the software platform that it currently operates to other dealerships inclusive of a servicing and advisory role.